So, you bought a house. First of all, congratulations! The search is over, no more weekends filled with open houses and showings, and you can finally breathe a sigh of relief. Phew.

But your work isn’t quite done yet. Once you buy a house, there are a few things that need to happen before and after move-in day. Check out our list of to-dos, and get prepared for what comes after closing—trust us, your future self will thank you.

Do a Deep Clean

When you first buy your home, there won’t be any heavy dressers blocking off corners, couches and beds to clean under, or stacks of boxes covered in cobwebs in the attic. Your house will never be this empty again—well, until you sell it, that is—so take advantage of the wide-open space.

Whether you want to hire professional cleaners or DIY, you should pour some serious TLC into your new house. Dust, vacuum, mop, scrub, polish—look up a few cleaning checklists for inspiration—and put in some elbow grease.

Change Your Address

This process will be a little tedious, but it has to be done. First, you should fill out a change of address form from your post office, so any mail sent to your old address will get forwarded to your new one—although these days you can even complete the process online!

Next, get in touch with credit card companies, your cell phone provider, and anyone else who will need to continue sending you bills. Big fan of online shopping? The last thing you want is for your package to get dropped off at your old house, so be sure to update your Amazon info, as well.

Set Up Utilities & Security

Running water, electricity, internet…all things you probably want working when you move in, right? If you already have a provider, you’ll need to communicate the change address to them, stop service to your old address, and set up a date for service to continue at your new address.

While you’re getting things installed, you should also consider setting up a security system. These days you’ll have plenty of affordable and high-tech options, so be sure to browse what’s available. At the very least, consider changing your locks, since old copies of the keys from the past owners could still be floating around.

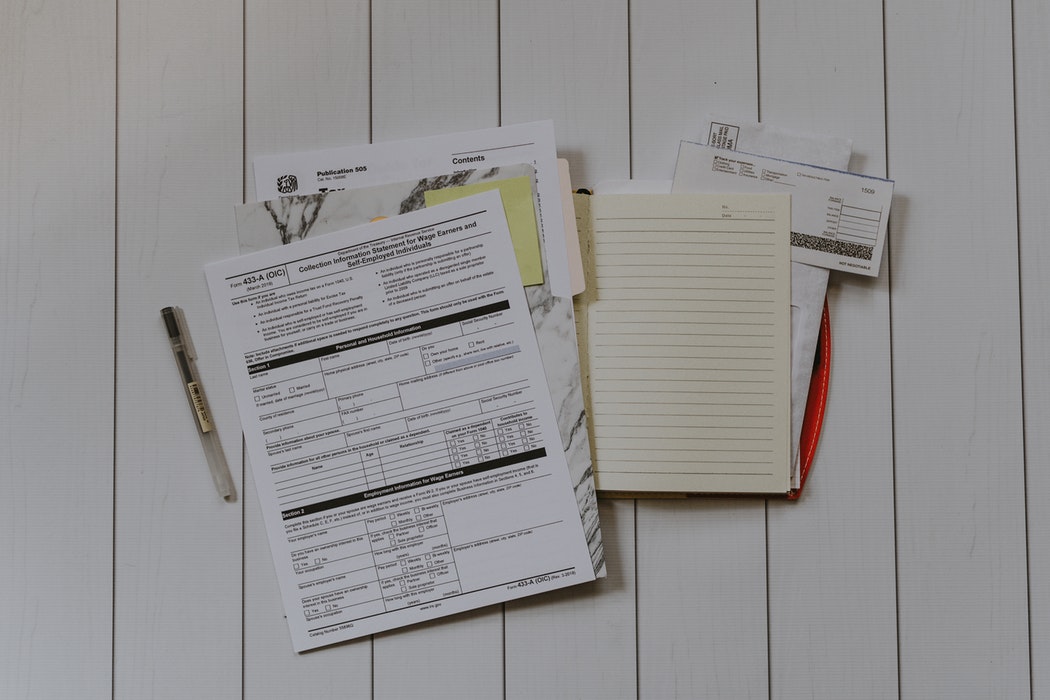

Keep Your Documents Organized

Once you’ve closed on your home, you’re going to have a lot of important documents to keep track of, and moving is going throw everything into chaos (although hopefully organized chaos) for a bit. As soon as you’ve closed and before you move in, collect all of the documents you used for your mortgage loan, as well as any copies of closing papers.

You never know when you might need some of them again, so invest in a secure storage system to keep them organized and around at all times.

Say Hi to the Neighbors

Even if you’re a little shy, it’s a good idea to introduce yourself to the neighbors once you move in. After all, close neighbors can help with anything from lending you an extra cup of sugar to watching your pets while you’re out of town.

You don’t have to organize a mixer or bake cookies for everyone, but just saying hello while you’re out and about can go a long way in establishing those important relationships.

Ready to Buy Your Dream Home?

Now that you know what to do after you’ve closed, let’s get started with your home search! From guiding you around the area to helping you navigate your mortgage options, our team is here to help you reach your real estate goals—and answer all of your questions along the way.

If you’re ready to get started or have a few questions, just give us a call today!